|

-

Posts

1,078 -

Joined

Content Type

Gallery

Forums

Calendar

Store

Musicbox

Everything posted by bkeiller

-

If he was on blood thinners, one knock to the noggin can be fatal.

-

Just got over Covid myself. Two weeks it kicked my butt and I had the shots and booster. My O2 saturation was down to 90%, but I monitored it with an oximeter. Took mucinex, vitamin D, iron and Colostrum supplements. No idea if the supplements helped, but I am through it on the back end. Still a bit out of puff. Likely woulda killed me if I hadn't been vaxxed. (Likely, I don't have much natural immunity!?) Hang in there!

-

Love him or hate him, Lou has been on the money regards much of the nefarious shitt going on in the markets, especially around the AMC play. He is consolidating his media at a dot com, now. Not much on there just now, but I sure it will be entertaining. youwillnevermistreatmeagain

-

🔥 Vast DOJ Probe Looks at Almost 30 Short-Selling Firms and Allies FBI said to show up at home of Citron’s Left in early 2021 Subpoenas to some firms since have sought info on dozens more By Katia Porzecanski and Tom Schoenberg +Follow February 4, 2022, 10:34 AM CST The Justice Department is collecting a trove of information on dozens of investment firms and researchers engaged in short selling as part of a sweeping U.S. hunt for potential trading abuses, according to people with knowledge of the matter. The Federal Bureau of Investigation seized computers from the home of prominent short seller Andrew Left, the founder of Citron Research, in early 2021, some of the people said. In more recent months, the Justice Department subpoenaed certain market participants seeking communications, calendars and other records relating to almost 30 investment and research firms, as well as three dozen individuals associated with them, the people said, asking not to be identified discussing confidential inquiries. Many on that roster -- a veritable who’s-who of the activist short-selling realm -- said they haven’t been contacted directly by the government, leaving some exasperated about being left in the dark. Reached for comment, Left also said he’s frustrated. The Department of Justice building in Washington, D.C. Photographer: Stefani Reynolds/Bloomberg “It’s very tough to defend yourself when you haven’t been accused of anything,” Left said. “I’m cooperating and I have full faith in the system and the First Amendment,” he added, referencing protections on free speech. The long list of names underscores the breadth of the Justice Department investigation first described by Bloomberg in December and shows how authorities are trying to map out alliances and understand how short sellers handle research and arrange bets that stocks will fall. It remains unclear which, if any, of the names mentioned in subpoenas might be targets of the inquiry or merely have ties to other people or entities of interest. SEC Scrutiny The Securities and Exchange Commission also has sent some requests for information, people with knowledge of those inquiries said. Spokespeople for the Justice Department and SEC declined to comment. No one has been accused of wrongdoing, and in many cases, the opening of a probe doesn’t lead to anyone facing charges. Prominent firms and their leaders mentioned in the Justice Department’s requests to some market participants include Melvin Capital Management and founder Gabe Plotkin; Orso Partners and Nate Koppikar; Sophos Capital Management and Jim Carruthers; as well as Kerrisdale Capital Management. The list also includes well-known researchers such as Nate Anderson and his Hindenburg Research, as well as Fraser Perring and his Viceroy Research. Representatives for most of those firms -- Melvin, Orso, Sophos and Hindenburg -- declined to comment or didn’t respond to messages seeking comment. “We haven’t been contacted by DOJ, SEC or any governmental authorities about any investigations,” Kerrisdale’s chief investment officer, Sahm Adrangi, wrote in an email. “We literally haven’t spoken to anyone at the government in many years.” Viceroy’s Perring said his firm also hasn’t received requests for information. “We will always cooperate with any such investigations and are happy to assist regulators in carrying out their duties,” he said. “All our reports are based on information that is publicly available, sourced from records that anyone at any given time could research or find. Our most recent contact with the DOJ was in assisting an investigation into the fraud at a company that we had researched.” Firms in the Dark Bloomberg had noted in December that Anson Funds, Marcus Aurelius Value, Muddy Waters Capital and Citron are part of the probe. Other firms mentioned in requests include Atom Investors, Bonitas Research, Connective Capital Management, Falcon Research, GeoInvesting, Gotham City Research, GrizzlyRock Capital, J Capital Research, Oasis Management, Park West Asset Management, QKM, Sabrepoint Capital Management, Silverado Capital, Spruce Point Capital Management, Valiant Capital Management and White Diamond Research. Representatives for many of those firms -- among them Falcon, GrizzlyRock, J Capital, Oasis, Valiant and White Diamond -- said they hadn’t been contacted by investigators. “It’s hard for us to comment on something we don’t know anything about,” said Taylor Hall, a representative for Oasis. Valiant “has a long-standing policy of cooperating with any inquiries it receives from regulators and other government bodies,” but is not aware of being involved in the short-selling probe, chief compliance officer Michaela Beckman said in an email. “Compliance with securities regulations has always been a point of significant emphasis at the firm since inception and we have not been subject to any regulatory action regarding insider trading or short-selling in our 13-year history.” “Ethics are a key part of my work, and I wouldn’t do anything unethical or untruthful,” said White Diamond’s Adam Gefvert. “I may write negative things about a company but I wouldn’t embellish anything. Everything is backed by proof.” Not all of the firms enter into public battles with companies. Atom invests in short-selling hedge funds. And GrizzlyRock isn’t an activist short seller, founder Kyle Mowery noted, adding that he’s glad the Justice Department is looking into that space. Representatives for the rest declined to comment or didn’t respond to messages. Pressure on DOJ Short selling often involves borrowing and selling shares, in a bet that they can be bought back cheaper later to lock in a profit. Investors may also use derivatives such as put contracts. The Justice Department and financial regulators have faced a growing number of calls in recent years to dig into short sellers and their research partners. Corporate executives including the world’s richest person, Tesla Inc.’s Elon Musk, have decried short sellers, accusing them of maligning businesses for profit. The Justice Department’s probe is being run by the fraud section with federal prosecutors in Los Angeles and there’s no public signal that authorities have drawn any conclusions. As Bloomberg previously reported, they’ve been examining trading in dozens of stocks, as well as relationships between funds and researchers, looking for signs that they manipulated markets or broke other laws to profit. Tough Times for Shorts Matt Levine's Money Stuff is what's missing from your inbox. The U.S. probe adds to a treacherous period for short sellers. Some bearish funds threw in the towel as government stimulus drove equity markets, a situation exacerbated during the pandemic. The pressure intensified during 2021’s meme-stock frenzy, when retail investors banded together to bid up shares of popular short targets, inflicting losses on hedge funds and other traders. By late January of last year, Citron vowed to give up short-selling research and focus on long bets. Read more: Short Sellers Face End of an Era as Rookies Rule Wall Street Some of the loudest short-selling critics include executives at companies that were later found to have engaged in malfeasance. But legions of small investors have also expressed outrage over stock slumps, especially during last year’s wild trading. Amid the complaints, members of Congress started demanding more government scrutiny. Researchers make money in a variety of ways beyond placing their own bets. Some sell insights to subscribers, or make arrangements to give clients, such as hedge funds, ideas in exchange for a cut of the profits. Paying customers often get to see research alleging problems at publicly traded companies before publication. One area of focus is how investors set up their bets that stocks will decline. Investigators have been looking, for example, for signs that money managers might try to engineer startling stock drops to induce selling by market makers or other investors, or engage in other abuses, such as insider trading, people familiar with the matter have said. — With assistance by Matt Robinson @KatiaPorzo@Tschoenberg22 https://www.bloomberg.com/news/articles/2022-02-04/vast-doj-probe-looks-at-almost-30-short-selling-firms-and-allies

-

A {final} meeting between Al-Sadr and Al-Amiri

bkeiller replied to yota691's topic in Iraq & Dinar Related News

😆 Sadr = dicktator Maliki = OG tator 😆 -

Wednesday Late Morning Opinions @ 11:33 AM CST - 2/02/2022

bkeiller replied to ronscarpa's topic in Dinar Rumors

This is the perfect bait and switch if they are saying 1190--even if they have no political control over the rate. It has to be a deep lie to work. At 1190, it is hardly going to create a run on their currency at that rate. The perfect cover? (Okay, just mental masturbation mixed with optimism, there.) 😆 -

Wednesday Early Morning Opinions @ 7:40 AM CST - 2/02/2022

bkeiller replied to ronscarpa's topic in Dinar Rumors

We only need this to happen once (the RV)! ... on second thoughts, it is Iraq, so it could happen multiple times! ... or never!? 😆 -

Rumored. Urgent Development - May Delay The RV/RI Process.

bkeiller replied to Luigi1's topic in Dinar Rumors

Maliki is the pox and anything he touches will be poxy. I'd rather lose my money than see someone like Maliki succeed. -

Rumored. Urgent Development - May Delay The RV/RI Process.

bkeiller replied to Luigi1's topic in Dinar Rumors

This is more about money, fighting, control and avoiding the hangman's noose. So, it's more of a blood fight. Now the US, yep, it is heading in the same direction and the commies, theocrats, and kleptocrats are laughing and eating our lunch. -

Saturday Morning Opinions @ 10:55 AM CST - 1/29/2022

bkeiller replied to ronscarpa's topic in Dinar Rumors

Sadr and Al-Kazemi is Al-Maliki's worst case scenario. You bet he will be using his stolen billions to subvert this alliance any way he can. Let the games continue! -

Here comes mecha-gozilla as predicted by Lou and it is coming a lot quicker than expected!? January 28, 20225:06 PM CSTLast Updated 18 hours ago Business U.S. SEC approves new U.S. exchange with blockchain feed, faster settlement By John Mccrank NEW YORK, Jan 28 (Reuters) - The U.S. Securities and Exchange Commission (SEC) late on Thursday approved the country's 17th stock exchange, a subsidiary of Boston-based BOX Exchange, which will incorporate blockchain technology. The new exchange, named BSTX, aims to launch in the second quarter, said Jay Fraser, a director. It will initially trade securities, such as stocks or exchange-traded funds, first listed on its exchange, but those securities would be tradable on rival bourses. ... https://www.reuters.com/business/us-sec-approves-new-us-exchange-with-blockchain-feed-faster-settlement-2022-01-28/

-

The clock is ticking regards the new legislation coming in from the SEC. Gensler said there is a 6-8 week backlog on administration and the public will get time to respond. So,this play really can't go past this year and will get interesting between now and the middle of the year. As a dinar holder, that is a blink of the eye!?

-

A {final} meeting between Al-Sadr and Al-Amiri

bkeiller replied to yota691's topic in Iraq & Dinar Related News

Love this! Sadr is spot on regards this particular issue and really is pushing Iraqi nationalism over Iranian proxies. Is Sadr going to be the guy who can take down Maliki? -

Found this lovely image on an Iraqi's Youtube channel. The post is three weeks old as of this post: Apparently, it is an old note from around 1984 or 1992. Folks in the rumor section are trying to figure out of this note is from that era or a rendering of a new note. We can always dream, huh? https://www.youtube.com/channel/UCjxIFEGF85as9DaQHwNxYvw/community?lb=UgkxNNokl9Gg2XvPr3bh1QJrWQHX1tXVdG0C

-

I am feeling a little blue today!

-

Iraq citizen on YouTube 15 min ago said News about dinar value incease

bkeiller replied to jg1's topic in Dinar Rumors

Looking through 'Nader from the Mid East's posts and found this lovely blue art. What is it? I don't know, but it looks nice. 😄 https://www.youtube.com/channel/UCjxIFEGF85as9DaQHwNxYvw/community?lb=UgkxNNokl9Gg2XvPr3bh1QJrWQHX1tXVdG0C -

Qaani arrives in Baghdad on an unannounced visit

bkeiller replied to yota691's topic in Iraq & Dinar Related News

What!? ... No drones to welcome him? -

Boom! Stocking up on a heavily discounted play at $15.89. Getting my dollar cost average down. No fear! 🍌 🍌 🍌

-

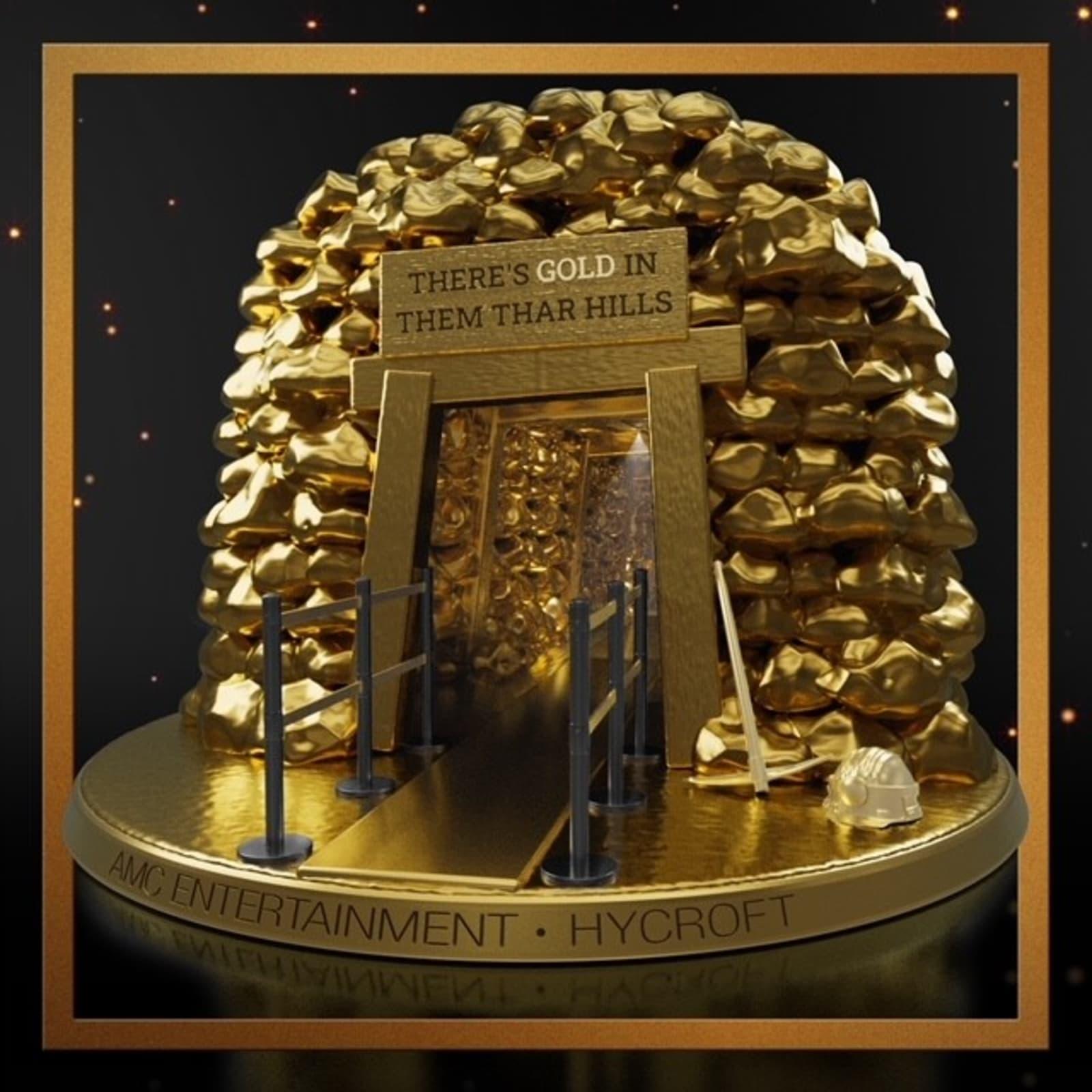

Swapped out my Iraqi dinar coins for my new 'I own AMC' NFT. HODLing like a dinar holder!

-

Boom! Piling on @$19.68 a share! Lowering my dollar cost average and fearless as a fool! Show me dem bananas. 🍌🍌🍌🍌🍌🍌🍌🍌🍌🍌🍌🍌🍌🍌🍌🍌

-

Great edjookashinal article on naked shorting and other insights into our current landscape (easy on the ears at x2)

-

Millions HODLing! Can Citadel self-immolate due to their shitty practices? 🔥 Keep turning the screw on Kenny-boys' 🌰🌰🗜️ Then bring on the 🍌🍌🍌🍌! 💎👏🦍

-

Citadel Securities Gets $1.2B Lifeline from Sequoia and Paradigm JANUARY 11, 2022 / 0 COMMENTS Citadel receives private funding for the first time ever Citadel Securities’ Ken Griffin just received a nearly $1.2 billion lifeline from Sequoia and Paradigm. This is the first time Citadel Securities has ever required private funding to stay afloat. The hedge fund lost billions of dollars in 2021 due to overleveraging their positions in so called ‘meme stocks.' Where is Citadel Securites headed in 2022? The company’s new valuation puts Citadel Securities at $22 billion. The hedge fund has proven to create massive systemic risk, even now as it continues to overleverage its short position in ‘meme stocks’ such as AMC Entertainment. Will it finally cut its ties to the ‘meme stock’ community and broaden its market? Or will it use every bit of capital they can to keep up with margin requirements in these plays? The ‘ape community’ continues to fight for a fair market Retail investors have been exposing Citadel Securities for unfair market practices. Share price from heavily shorted stocks have been suppressed by hedge funds through a variety of market manipulation tactics. CNBC’s Melissa Lee and Fox Business’s Charles Payne have called out the use of naked shorting in the markets too. Dark pool trading in AMC and GME stock have gone as high as 60%-90%. The community has recently uncovered how private ‘family offices’ also provide hedge funds with a loophole to unregulated trading; as seen with Archegos Capital. Retail investors in the ape community have scrutinized Citadel Securities for imposing predatorial strategies that will prevent them from getting squeezed from their overleveraged short positions. The SEC might have turned the cheek, but retail investors aren’t leaving. Read: Here’s why Citadel’s customers are about to lose everything Related Here’s Why Citadel’s Customers Are About to Lose Everything December 23, 2021 In "Community" Gary Gensler Under Fire By Retail Investors [Leak] October 1, 2021 In "Community" The SEC Is Looking Into Citadel Securities’ Business Model October 14, 2021 https://franknez.com/citadel-securities-gets-1-2b-lifeline-from-sequoia-and-paradigm/#comments

-

As an avid gardener, I will continue to 'keep this shitt spreading.' Go righteous apes! 💎👏 🌎 🚀 🌙 🍗 + 🍌🍌🍌 = 💰🏡🏘️✈️🏨🏖️🥂🥃🌲🔥🌬️