|

-

Posts

16,784 -

Joined

-

Last visited

-

Days Won

73

Content Type

Gallery

Forums

Calendar

Store

Musicbox

Posts posted by Adam Montana

-

-

-

3

3

-

2

2

-

2

2

-

-

- Popular Post

- Popular Post

Good afternoon, beautiful dinarians!

First order of business... DATE CHECK. Yep, it's the 12th of August.

So far so good!

I had planned on doing a longer update last week. Or Weekend. Or early this week.

None of that happened

, and I apologize. Time just got away from me, family matters took precedence, and the VIP matters took more of my time than I anticipated. It happens.

, and I apologize. Time just got away from me, family matters took precedence, and the VIP matters took more of my time than I anticipated. It happens.

And here we are, well past the morning, and the day is getting away... again.

Moving on!

The big news of the day (domestically) seems to be Joe Biden has picked a VP. Jump in that conversation here.

That's enough of that stuff

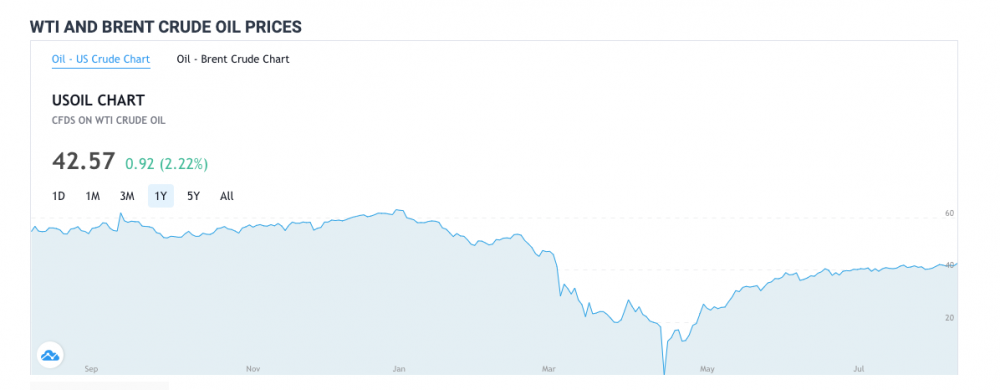

OIL - happy news for Iraq, and this does nothing but bolster their confidence.

We know it's going to go back to former levels seen this year. We can be fairly certain this current low rate won't stick around... and of course I'm talking about both OIL and also Dinar.

As much as I state that the Auctions aren't an indicator of an RV, the continued solid auctions just prove that Iraq is a well oiled (haha) machine.

The current auction prices won't stay where they are.

One of the biggest events on the calendar is our boy Kazzamie coming to America. Check it out here, and bookmark that page to follow along. I love the progress. I want to see some HCL news, but it's very possible that they are lining a few things up before it goes through.

When we have HCL, I believe we will get our RV.

It's coming!

This is worth a look. Engineer says not to take microchip.

And when you're done reading up on the Iraqi news... maybe spend some time in the Music Videos section. Lots of good jams in there! 🎸

That's it for now... go HCL, go Kazzammie,

GO RV!!!!!!!

P.S. Get in the powerball pool!

-

10

10

-

17

17

-

3

3

-

11

11

-

I have not received word from any of my contacts... not sure what's going on there, but I wouldn't freak out.

-

1

1

-

5

5

-

4

4

-

-

3 hours ago, lost one said:

Still waiting for the update on Sunday....Himmmm...Must be nothing happening or your Sunday was a little more active than you thought.

I admit it - it was! I ended up with unexpected company and the entire week got thrown off.

Sorry about that!

-

1

1

-

2

2

-

5

5

-

-

5 hours ago, rayh56 said:

"You are correct, but the most important part of the member's post is the fact that they didn't get the email. Looking at their profile, I can tell that they are still using an email address here that we have NEVER been able to fix... COX. They are notorious for blocking all kinds of emails, regardless of how many times their customers call to tell them to stop!"

I will change my Email address to a Yahoo account.

Thanks

Yahoo is better than cox, but gmail is better and has always been the only email provider to consistently be reliable. Also the only preferred and suggested email for communication with us here.

To each their own, though.

-

2

2

-

3

3

-

-

6 hours ago, rayh56 said:

I did not receive an email and I'm in the VIP!" rel="">VIP

See my post above.

-

1

1

-

2

2

-

2

2

-

-

3 hours ago, Hearts said:

Great job Adam! Love the idea of the TIN, which I immediately took advantage of this opportunity.

You and a few others! It's something that more than a couple members were very excited about. I'm not surprised you also see the value in it, having known you for these years.

6 minutes ago, yendor said:

6 minutes ago, yendor said:I hit submit before I finished. What I meant was the VIP!" rel="">VIP section has the same update as the email update.

You are correct, but the most important part of the member's post is the fact that they didn't get the email. Looking at their profile, I can tell that they are still using an email address here that we have NEVER been able to fix... COX. They are notorious for blocking all kinds of emails, regardless of how many times their customers call to tell them to stop!

I added the link to the first post here, just the same. I can tell people to "switch to gmail and you'll always get my emails!" but it's up to the member to make the change.

🤷♂️

-

2

2

-

3

3

-

-

I know this was a short "update"... those of you in VIP and OSI should see why by now.

Good things coming our way!!!!

-

5

5

-

4

4

-

5

5

-

-

- Popular Post

- Popular Post

Good morning good morning!

Date check... YEP, it's August 5. 👌

There is a lot going on right now in the Dinar world. I'll do a breakdown of the articles and news later this week, possibly Sunday, but definitely before next Wednesday.

For this morning, I just wanted to pop in and say "hi"!

Interesting threads of the moment:

- Of COURSE the Weekly Powerball Pool. (You can't win if you don't play!)

- NESERA / GESERA - I've been receiving a lot of messages about this one. I'm not ignoring it on purpose, as I was accused of in one message! I'm just holding comments for now... but it's certainly worth a look! Check it out here.

-

For those in VIP - A VIP update.* (email going out in 3... 2... 1... you should have it by the time you read this.

)

)

*I touched on some items in that VIP update that are extremely important, and the work that I referenced there has my calendar busy (BUSY!) for the moment, so I'll end this here and get back to it.

Have a FANTASTIC day, everyone!

Go HCL... go Iraq... GOOO RRRVVVV!!!!

- Adam

***** edit - adding link to the VIP post that was sent via email ---> Here it is <----

-

5

5

-

17

17

-

1

1

-

6

6

-

Staff: 14 17 29 46 69 PB 15

Am I the only one sometimes concerned about entering the wrong numbers due to a typo, and then the wrong numbers "winning"?! I double check my powerball numbers way more diligently than I check the dates on my Weekly Updates

-

1

1

-

-

Me: 18 26 35 38 64 PB 09

Staff: I neglected to purchase theirs this week... I'll update later if I can!

-

- Popular Post

- Popular Post

On 7/29/2020 at 6:19 PM, DinarThug said:

And The Kurds Just Announced A Five Day Holiday !

The suspension of official working hours in Kurdistan 5 days, starting from Friday

29th July, 2020

Today, the Kurdistan Regional Government announced a 5-day official holiday, starting from 7-31-2020, until Tuesday 4-8-2020.A spokesman for the Kurdistan Regional Government, Gutiar Adel, said in a statement, that the holiday includes all official institutions in the region, as it will resume work next Wednesday.

The statement called on citizens to adhere to preventive measures, during the days of Eid, to confront the Corona pandemic.

Yesterday, Tuesday, the General Secretariat of the Iraqi Council of Ministers announced the suspension of official working hours on the occasion of Eid Al-Adha, coinciding with high temperatures.

On 7/29/2020 at 6:24 PM, DinarThug said:

And Now He’s Headed To Washington !

Member of foreign relations: Al-Kazemi's visits to Riyadh and Washington were not canceled

Localities 2020/07/29 20:58 131

Baghdad today - Baghdad ,

a member of the Foreign Relations Committee, Amer Al-Fayez, confirmed today, Wednesday, that the foreign tours of Prime Minister Mustafa Al-Kazemi of the Kingdom of Saudi Arabia, and the United States of America, existed and were not canceled.

Al-Fayez said in an interview with (Baghdad Today), that "Al-Kazimi's visit to Saudi Arabia was postponed as a result of the illness of the King of Saudi Arabia, who after his recovery will be a visit," noting that "the Prime Minister's visit to Washington will be this month."

He explained that "both visits work to support system' target='_blank' style=" rel="">support system" rel="">support the openness of Iraq to the region and neighboring countries and the world, and taking into account balance in the region because Iraq can play an important role by being a friend of Iran, Saudi Arabia and the United States and playing the role of calm."

He noted that "

He stressed that "the visits remain, and the invitation is ongoing and awaiting the order of things."

Al-Kazemi’s government is trying hard to ease tensions in the country and maintain a balance between regional and international powers in order to embark on its reform plan.

While the Saudi station was postponed on Al-Kazemi’s tour after coordination and consultation between the two capitals, Baghdad and Riyadh, Al-Kazemi visited Tehran and met senior Iranian officials, including the leader of the Islamic Republic, Ali Khamenei, and received supportive positions for his government.

I'm hearing rumors (from people I actually listen to rumors from) that this "holiday" may be less of a holiday than usual. Perhaps it's a strategic pause in the usual updates from Parliament, and it will culminate with something big.

🤞

On 7/29/2020 at 10:43 PM, gp49 said:Thanks again! If I had a dollar for every time that I have said on this amazing site.... I would be able to buy a few more million Dinar! 🧨🧨🧨

You only have 6xx posts, so I"m going to ask you to share your source for cheap IQD!

-

6

6

-

6

6

-

6

6

-

10

10

-

1 hour ago, BigJake said:

I asked this before but could not find an answer. If it rv’s at $ .10 could we cash in part of what we have and exchange the rest for lower denominations? If so wold we have to pay the spread and/or taxes?

I think pretty soon it's going to be mandatory to answer the question first...

"Have you read the Cash In Guide"?

I'll watch for your answer

-

4

4

-

3

3

-

2

2

-

-

- Popular Post

- Popular Post

Good morning DinarVets, Happy Wednesday!

Hump day is here again, so the first thing I did was... double check the DATE on my title

Today IS the 29th. So far, so good!

I don't have to tell everyone this (thanks to everyone who emailed!), but the site was down for maintenance earlier this week. It will be down again, possibly a few times, over the coming days. We are adding some functions, revamping some backend stuff, and making improvements.

Don't worry - the downtime will be limited and short.

WHY these changes are happening now should be obvious if you read the news and keep up with the developments.

Change is coming, and I plan on being over-prepared.

We are also going to be doing some tests on some internal systems... including the "RV Text" system. This will NOT happen until 1) I send the email announcing it, and 2) you follow the instructions you are given. Please do NOT make a post saying "I didn't get the text!". (Now that I've written that, I am expecting only half of the usual posts saying "I didn't get the text"

)

)

Full details on the changes will be released in short order. Other than the upcoming TEST text, the only time you will get a text from me is still the RV announcement.

Before we have an RV, we need the HCL to be done. I'm more certain of this than ever... and activity in Parliament regarding the HCL has been higher lately than it has in years.

In fact, it was on the agenda for today. (Has anyone kept track of how many times they have mentioned it this month alone?!)

I continue to be extremely impressed with how Kazzammie is moving things forward. This guy should have been hired a long time ago!

Don't get too excited, at least not quite yet... I don't expect to see the RV announced until the HCL is completed. And I don't expect the HCL to be announced as completed until they are ready to RV. These are likely to be two simultaneous announcements, judging from how things are proceeding.

The headline will look something like this:

Quote"HCL completed. The profit sharing agreement between all (parties) has been implemented to satisfaction; CBI announces an immediate increase in exchange rate for the Iraqi Dinar from (X) to (!!!)."

Of course, that will be in Arabic. And the translations will vary, but the end result is the same:

Higher exchange rate = Profits for us.

Being in VIP here at DinarVets guarantees you a couple things, only one of which is that Text Message I mentioned above.

We are also going to get a better return on our exchange by reducing the spread - if you don't know what that means, for the LOVE OF PETE PLEASE READ THE CASH IN GUIDE! It's free, it's short, and you have nothing to lose by reading it.

There is much, much more, but when the very first thing you get is more money in your pocket... do I really need to say more?!

Rather than spending my time on breaking down the news articles this morning, I'm going to get back to the nerdy and thankless work that goes on in the background here. I'll invite everyone to post any specific questions you have on (Iraq, HCL, Kazzammie, etc) below, but please don't ask about the site changes yet - I'll send an email and make an official post when these upgrades are complete.

Have a fantastic day, everyone!

Go Iraq.

Go HCL.

GO RV!!!!!!!

- Adam

P.S. Can't forget the Weekly Powerball Pool!

-

6

6

-

26

26

-

1

1

-

16

16

-

1 hour ago, Rochester said:

Is it July 23?

There I go getting ahead of myself again... 🤦♂️

There I go getting ahead of myself again... 🤦♂️

-

1

1

-

4

4

-

10

10

-

2

2

-

-

- Popular Post

- Popular Post

Good morning folks, Happy Wednesday!

OIL - over $40. Good enough!

OIL is an interesting spot to start this chat because... well because "OIL". OIL is the reason Iraq has this unique opportunity and it's the foundation for their wealth - past, lost, present, and future.

If Iraq didn't have the natural resources, this site wouldn't exist.

The opportunity wouldn't be here.

But, they do, and we are here. Our man @yota691 just posted this article where our other man Kazzamie gives us a little "read between the lines" material. At first glance, it sounds like the article is describing a normal visit to a neighboring middle eastern country.

Upon deeper investigation, you should realize that Iraq has successfully migrated from the place where Iran was manipulating them, to their current position of strength with Iran.

Iraq is no longer a puppet of Iran.

This is one of the best possible scenarios for us! I wouldn't say it was mandatory for a progression of the RV timeline, but it's most certainly a positive thing!

Iran isn't the only place Iraq and Kazzammie are working. We're also witnessing positive Saudi news.

We also have news regarding Iraq's oil exports... and they are NOT complying with the OPEC+ agreement. It was my opinion all along that they would not comply with that agreement... they are nodding "yes", but doing exactly what they want at the same time. Iraq is moving forward, they are strengthening all aspects of their situation... and that is GOOD for us!

How many "thumbs up" emojis can I use in one day?! Don't worry, I'm not done yet - there's more coming!

In the VIP section, I'm working on a couple of things. One is a "What-To-Expect-And-Do-Post-RV" post/guide. As I was going through that project, I decided to incorporate it into a sort of "VIP Verification" project, which is tied to another project that will revamp and revise the Text Message Service. (When the RV is announced, part of the VIP benefits here is a text message to you notifying you of the event.)

I'll be sending out an announcement once that's complete - I'm expecting it done and launched by middle of next week, unless we have an RV in the meantime. If that happens, please note that the current Text Service is functioning perfectly, and anyone who has paid for it will get their text. The Text Service will NOT change, and NO TEST TEXTS will be sent, until I make the public announcement.

Part of the "VIP Verification" project is going to be a short quiz on the Cash In Guide - many people still haven't invested the 7 minutes into themselves and their future, and this kind of blows my mind! It's a free guide, it's a short read, and you might be amazed at how many questions will be answered when you read it.

For your own peace of mind... just grab a copy and read it over your morning coffee or on the next bathroom break. It's really that short, that simple, and it's free! Get it here.

Ok, my thumbs are getting lightheaded here... time to get to work.

Don't forget the Weekly Lotto Pool - get in!

Go Kazzammie, go HCL, go Iraq....

GO RRRVVVV!!!!!!!

- Adam

-

7

7

-

18

18

-

2

2

-

14

14

-

I love how they are shooting for an "average". That means Iraq can still export more than agreed as long as the other countries export less. It still averages out

-

1

1

-

3

3

-

-

11 hours ago, Pitcher said:

The world may soon return to an international gold standard

Hard to take the article serious after a statement like that. That's like a neon sign over their head saying "I don't understand money"

-

2

2

-

2

2

-

1

1

-

-

Me: 34 55 58 59 69 PB 24

Staff: 03 28 38 48 57 PB 06

-

8 hours ago, screwball said:

its simple you exchange into USD you pay tax, if you gift money to a friend or relative they do not pay tax....

That's not correct.

8 hours ago, screwball said:what happens if you transfer IQD into a foreign currency account? in another currency? is this a taxable event?

When you profit, that is generally taxable.

8 hours ago, screwball said:whenever you exchange currency (IQD) to another you (AUS or USD) you have created a taxable event, this means you pay tax the longer you have it the less tax! correct me if I am wrong!

With some investments there is a difference depending on how long you held the investment. Foreign currencies are a bit of a wildcard, and our specific situation falls under the "hope for the best" guidelines and regulations.

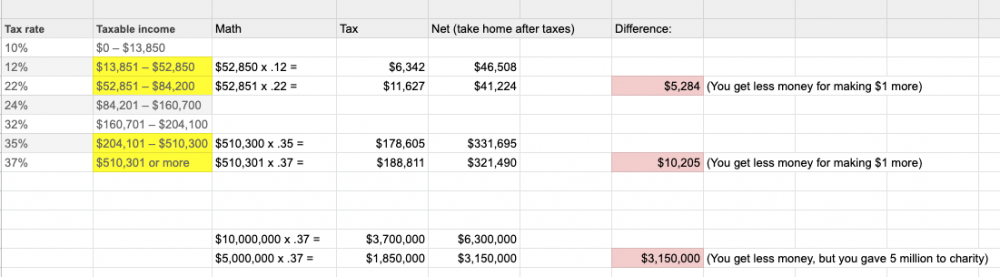

Most likely the profits from a major revaluation of this currency will be treated as normal income, and taxes will be owed accordingly.

Tax rate Single Married, filing jointly Married, filing separately Head of household 10% $0 to $9,875 $0 to $19,750 $0 to $9,875 $0 to $14,100 12% $9,876 to $40,125 $19,751 to $80,250 $9,876 to $40,125 $14,101 to $53,700 22% $40,126 to $85,525 $80,251 to $171,050 $40,126 to $85,525 $53,701 to $85,500 24% $85,526 to $163,300 $171,051 to $326,600 $85,526 to $163,300 $85,501 to $163,300 32% $163,301 to $207,350 $326,601 to $414,700 $163,301 to $207,350 $163,301 to $207,350 35% $207,351 to $518,400 $414,701 to $622,050 $207,351 to $311,025 $207,351 to $518,400 37% $518,401 or more $622,051 or more $311,026 or more $518,401 or more -

3

3

-

2

2

-

2

2

-

-

The test text will not go out before I send an email announcement and also post it here in VIP. Also, you will need to initiate it.

This may not be done before the end of the week - my programmer/designer is still dealing with some issues and I decided to just hold off and wait for now, since the current text service is functioning perfectly as it is.

This is coming, don't worry! But also - thanks for your patience. It will be worth the wait.

-

4

4

-

5

5

-

3

3

-

-

Jacks, welcome!

Those are fair questions, we all asked something like that at one time.

It’s also kind of a “how much wood could a woodchuck chuck” question

Nothing in life is guaranteed. If you want to make God laugh - make a plan for yourself.

-

3

3

-

1

1

-

-

-

14 hours ago, KristiD said:

if your dinar ended up being worth, say, US$10 million after the RV, you could actually gift half of it to a charity and get a US$5 million write off on the other half you cash in for yourself.

Great post KristiD!

One clarification on this part, because a lot of people misunderstand it. Charitable contributions don't work as generously as that in most cases. The deduction actually applies to your taxable income, not your tax liability.

It's still beneficial to use the deduction, if you choose to give to charity. Here's an example of how it works (this isn't the place to get too deep into tax rules) - I'm using head of household for simplicity.

Giving $5 million to charity didn't reduce our taxes by 5 million - it reduced our taxable income by 5 million.

-

4

4

-

5

5

-

D.V. lottery games for 8/18--8/19--2020

in DV Weekly Powerballs.

Posted

Me: 12 15 21 32 46 PB 13

Staff: 01 29 45 50 60 PB 14

GL everyone!!! 🍀