|

-

Posts

27,878 -

Joined

-

Last visited

-

Days Won

454

Content Type

Gallery

Forums

Calendar

Store

Musicbox

Posts posted by DinarThug

-

-

Al-Kazemi resolves the controversy: The scheduling of the withdrawal of foreign forces is determined by this committee and not others

Policy , 04/24/2021 19:01

Baghdad - Iraq today:

The spokesman for the Commander-in-Chief of the Armed Forces, Major General Yahya Rasool, confirmed, Saturday (April 24, 2021) that the schedule for the withdrawal of foreign forces is determined by the technical committees within the strategic dialogue.

Al-Kazemi's spokesman said:

“There is a schedule for the withdrawal of foreign forces during periods to be determined after the meeting of the technical committee formed by the command of the Commander in Chief of the Armed Forces, headed by the Chief of Staff of the Army to manage this file within the strategic dialogue,” pointing out that “Iraq does not need any American soldiers Or a foreigner carrying arms and fighting with the Iraqi forces and does not need fighters on the ground, except for the Iraqi forces. "

He added that "Iraq is working with NATO, and the purpose of this topic is training and equipment of the military leadership," stressing that "Iraq has trained forces that can defend the homeland and the people."

Rasul explained that "the investigation committees are continuing and the intelligence effort is continuing with regard to targeting headquarters, airports and international missions with missiles and pursuing the sources of bombing," indicating that "announcing the results is left to the high military leadership."

He pointed out that "targeting the airport or any area with missiles, which are not smart missiles, that fall on Iraqi military installations and bases and victims are Iraqis."

Fully building the capabilities of the armed forces to be able to protect the country. "He pointed out that "the fact that some armed groups did a certain movement or show, this is an incorrect message because everyone fought terrorism," stressing that "

-

2

2

-

1

1

-

-

7 hours ago, Luigi1 said:

From Okie’s telegram room, ….Tony verified my news from yesterday

Telegram For Okie From ‘TNT’ Tony !

-

5

5

-

-

Parliamentary Committee: The Mineral Investment Law is ready to be presented to the Presidency of Parliament

24th April, 2021

Parliamentary Economic and Investment Committee is preparing to present the mineral investment law to the Presidency of Parliament in order to include it on the agenda for the first and second readings.Committee member Nada Shaker Jawdat said, "The law has been completed by 90%, and it is a law that deals with how to invest all minerals in the country, except for oil covered by a special law."

She added that "the law has been continuously worked on, and those concerned with it from geologists and others have been hosted."

##############

Parliament movement to put forward the mineral investment law

04/24/2021 09:07:49-

1

1

-

2

2

-

-

New conversations about the price of the dollar in Iraq .. What will happen to it after the end of the budget?

2021-04-24Yes Iraq: Baghdad

On Saturday, the Parliamentary Finance Committee suggested that the current price of the dollar would remain for years, while it indicated the central bank's ability to control its current price in the market and prevent it from increasing further.

Committee member Shirwan Mirza said in a statement to the official newspaper affiliated with "Nas", "The current exchange rate of 1450 dinars against the dollar and determined by the Central Bank may last for years, as it cannot be reduced because the budget is built on it."

He added, "With regard to the rise in the price of the dollar beyond the 1470 dinars, we believe that there is an attempt by the central bank to stop the rise.

The bank has a strategic stockpile of the dollar and it can contribute to the stability of the exchange rate and not to rise more than that."Parliamentary conversations had emerged in previous periods about the possibility of changing the price of the dollar and reducing it after the end of the current budget, that is, after the end of the current year.

-

2

2

-

-

Parliamentary Energy resolves the controversy over the questioning of the Minister of Electricity ... and comments on the oil and gas law

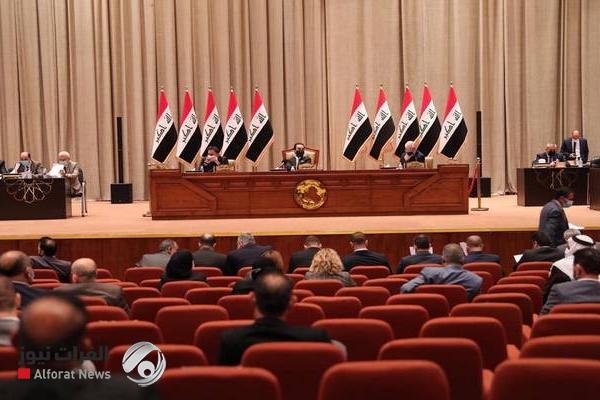

04/24/2021 16:53:14The Parliamentary Energy Committee settled, on Saturday, the controversy over the issue of the questioning of the Minister of Electricity, "Majid Hantoush," under the dome of the House of Representatives in its next sessions.

A member of the committee, Amjad Al-Oqabi, told Al-Furat News that "there is no such thing as an interrogation of the Minister of Electricity, and it is not completely presented and there is nothing to be questioned by the minister."

It is noteworthy that Parliament is heading to question the Minister of Electricity, Majid Mahdi Hantoush, in light of fears of a possible collapse of the system, after the aggravation of the crisis of declining hours of supplying national electricity in Baghdad and the provinces of the Middle Euphrates again, in conjunction with high temperatures and the outbreak of the Corona virus.

Al-Uqabi added,"As for the oil and gas law, it will be transferred to the next parliamentary session for controversy over its provisions.

It also needs many and many sessions to approve it."Al-Oqabi indicated, "But if Hayat, the presidency of Parliament, insists on going ahead with it, we will have 5 months before he dissolves himself to run for the early elections to be held on October 10, 2021," hopefully.

The Parliamentary Oil and Energy Committee approached the Cabinet and the Ministry of Oil for the purpose of expediting amendments to the oil and gas law and sending it to Parliament.

And Oil Minister Ihsan Abdul-Jabbar Ismail stressed the importance of expediting the passage of the federal oil and gas law, and its importance in regulating the management of oil and gas wealth in Iraq.-

6

6

-

-

5 hours ago, Carrello said:

All you Christopher Columbus wannabes keep dreaming.

Exactly - Which Somehow Might Possibly Explain How We All ‘Luckily’ Managed To Navigate Ourselves Into Such A ‘Lucrative’ Investment !

-

1

1

-

4

4

-

-

1 hour ago, dinarham said:

Thug , You better bone up on your geography .

Iraq is at the top of the crack and the poop hole is south

Well Then That Would Probably Help To Explain All Of The Kraperoni ‘Floating’ In That Part Of The Ocean There !

-

1

1

-

-

1 hour ago, boosterbglee said:

All this time I thought the Earth was round, flat by a few......now we know the truth with a real photo😂

2 hours ago, dinarham said:Iraq is at the top of the crack ?

Ya, Booster - And U Can See How Its Divided Into The 2 ‘Hemispheres’ !

And Dinarham - Iraq Is Located Right At The Center Of The Shiite Hole ...

-

8

8

-

1

1

-

-

17 minutes ago, Luigi1 said:

Luigi found this...

TNT Bank Story: I handed him some Dong. His eyes got big.

Now That’s Some Outstanding BS Bank Story Reporting There Weegie - Butt Be Careful About Who U Let Hold Ur Dong !

-

1

1

-

5

5

-

-

1 hour ago, DinarThug said:1 hour ago, dinarham said:

What more do you want , World ?

Idk - Perhaps A Better Location ?

-

8

8

-

-

-

On 4/11/2021 at 4:25 PM, DinarThug said:

After 50 deputies were injured, Corona mortgages the fate of the next parliament session

11th April, 2021

The representative of the Parliamentary Wisdom Bloc, Ali Al-Badiri revealed, on Sunday, that 50 deputies in the House of Representatives had tested positive for Corona virus.Al-Budairi told Shafaq News Agency, that "holding Parliament sessions on April 20 is very unlikely, due to the high rate of Coronavirus infections among MPs."

He added, "There are more than 50 deputies infected with Coronavirus, and this threatens the holding of Parliament sessions this month."

The Presidency of the Council of Representatives announced on April 8, the end of the first legislative term for the third legislative year, and set on Tuesday April 20 as the date for the start of the implementation of the second legislative term for the third legislative year.

He revealed the reason for not holding Parliament sessions recently

23rd April, 2021

A deputy revealed the reason for not holding the House of Representatives sessions this week.The head of the National Coalition, Kazem Al-Shammari, said in a press statement, that "the postponement of the sessions is linked to the spread of the Corona pandemic, in addition to the parliamentary committees' preoccupation with some work."Al-Shammari ruled out that the failure of the House of Representatives to hold its sessions on last Tuesday and Thursday is related to the matter of lifting the immunity of some of the wanted deputies.

It is noteworthy that parliamentary sources say that the deputies infected with the Corona virus number up to 50 out of 329 members, whose infections range from mild to moderate.

She added that there are 11 MPs, who are in critical condition, and receive support from ventilators, "noting that" the health condition of these people is similar to that of the late MP Adnan Al-Asadi."

It is noteworthy that the number of parliament members who died as a result of the complications of the Corona virus reached five, and they are: the representative of the Iraqi forces, Ghaida Kampash, the representative for Diyala province, Hussein Al-Zuhairi, the representative for the Wisdom Movement, Ali Al-Aboudi, and the spokesman for the Kurdistan Democratic Bloc in Parliament, Representative Aram Naji Baltiye, And MP for the State of Law coalition, Adnan Al-Asadi.-

1

1

-

3

3

-

1

1

-

-

Barzani: Baghdad and Erbil made mistakes and we must learn from them

09:22 - 04/23/2021The President of the Kurdistan Region, Nechirvan Barzani, affirmed that the two federal governments in Baghdad and the Kurdistan region in Erbil made mistakes regarding the pending differences between them for many years, stressing the need to learn from mistakes and move forward in resolving disputes and building a better future for Iraqis in general.

Barzani said in a televised interview with his / her / the information /, that "the differences that are still pending between Baghdad and Erbil," indicating that "the problem lies in how to think, so it cannot be solved based on the logic of force.

He pointed out that "Iraq is like one family, and family members must sit at the dialogue table to solve all problems."

He continued, "We must learn from the lessons of the past, as Baghdad and Erbil made mistakes, and the most important thing is the political and economic stability of Iraq. We must diagnose the problems and find solutions to them."

Barzani stressed that "Baghdad and Erbil complement each other, and we must complete the concept of citizenship, and form a true partnership," noting that "the Iraqi people deserve a better life, and all components and politicians must work on that."

Barzani indicated that "Iraq will go on the path of change, given that the new generation will not accept the old slogans and will work to change the current reality."

-

3

3

-

-

Barzani to European diplomats: Baghdad has not sent any salaries to the region for 10 months

20th April, 2021

The President of the Kurdistan government, Masrour Barzani, informed the representatives of the European Union countries in the region, on Tuesday, that the federal government has not sent any salaries to Kurdistan for ten months, indicating that Erbil is committed to implementing the budget law in return for Baghdad to fulfill its obligations regarding financial dues.

A statement by Barzani’s office received by the Tigris stated that “the President of the Kurdistan Regional Government, Masrour Barzani, met today, Tuesday, with consuls and representatives of the European Union countries in the region,” indicating that “the meeting discussed the situation in the Kurdistan region and the relationship with the federal government, as well as discussing ways. Strengthening relations between the region and the European Union."

Regarding the relationship with the federal government, Barzani stressed "the commitment of the Kurdistan region to implement the federal budget law, and called on the federal government to fulfill its obligations towards the Kurdistan region," indicating that "it did not send any salaries to the region for ten months."

Barzani expressed his hope that "the approval of the House of Representatives on the budget law will be a good start to finding a radical solution to other outstanding issues on the basis of the constitution, especially the implementation of Article 140 and the normalization of conditions in the Kurdish regions outside the administration of the regional government," considering that "this will have a positive impact on The security and stability of Iraq."

-

1

1

-

4

4

-

-

11 minutes ago, DinarThug said:

The launch of the first “digital economy” service a few days later in Iraq: The fate of the fines will be guaranteed .. What does it mean to pay money over the phone?

2021-04-23The government calls on Huawei to contribute to the digital transformation in Iraq

22nd April, 2021

The Secretary-General of the Council of Ministers, Naim Hamid Al-Ghazi, on Thursday called on Huawei to contribute to the process of digital transformation and the establishment of smart cities in Iraq."The Secretary General of the Council of Ministers, Hamid Naeem Al-Ghazi, called on the Chinese company Huawei, to actively contribute to the process of digital transformation and the development of the e-governance program and the establishment of smart cities in Iraq," said a statement of the General Secretariat received by the information.

He added, during his meeting with the president of the company in the Middle East, Charles Yang, that the General Secretariat of the Council of Ministers has reached advanced stages in the e-governance program, and it needs a real partnership with a sober company, such as Huawei, the leading company in the fields of technology and communications, in order to provide advice, visions and plans to ensure Of developing the program.

He pointed out the need to expedite sending experts and specialists to Iraq to start bilateral meetings in the presence of members of the Supreme Committee for e-Governance, as well as Iraq's desire to open a special academy to train and develop the skills of Iraqi employees working on the program.

Yang expressed the company's happiness in opening horizons for cooperation with Iraq in the digital field, that there is a real desire to work in Iraq to develop electronic programs and develop skills, and that the police possess all capabilities to provide the required consultations, praising the experiences and competencies of Iraqi youth in the digital field, by obtaining centers It is ahead of the Middle East and the world in the competitions and courses organized by the company during the past years.

The company presented a presentation of the projects and programs it implemented in many countries of the world, which contributed to the development of the digital field in all government sectors.

-

2

2

-

-

Political moves to prevent corruption files from being opened about the disappearance of huge sums of money in Anbar

14:45 - 04/23/2021An official source in Anbar governorate said, Friday, that there are political moves to prevent the opening of corrupt files about the disappearance of huge sums of money in Anbar.

The source said in a statement to Al-Maalouma Agency that “prominent political leaders are afraid of issuing arrest and summoning orders against senior officials in the current and previous Anbar government against the background of information indicating that the judiciary intends to issue orders against senior officials who committed financial and administrative corruption operations while they assumed administrative positions.”

He added, “The Administrative Court issued arrest and summoning orders on all members of the Anbar Council before its dissolution on charges of the disappearance of huge sums of money, and the file was closed at the time, indicating that“ the stage of entry of the ISIS terrorist To the governorate and the previous displacement of citizens, many projects have been marred by financial and administrative corruption by senior officials in the governorate and the disappearance of billions of dinars allocated to projects and the displaced.

It is noteworthy that the era of ISIS terrorists witnessed the disappearance of huge sums of money, the fate of which has not been revealed until this hour in Anbar.-

4

4

-

-

On 4/21/2021 at 9:58 PM, DinarThug said:

End the power of lagging investors on state land

Thursday April 22, 2021

Baghdad: Hazem Muhammad HabibThe head of the National Investment Commission, Suha al-Najjar, promised Prime Minister Mustafa Al-Kazemi to cancel all licenses for investment projects whose completion rate ranges between (0-35%) And the time period available for its implementation has ended, an important decision, indicating that the directive, which will cancel 1,128 investment licenses, will return to the state about 400 thousand dunams, with an estimated value of 90 trillion dinars.

Al-Kazemi had also directed, during his visit to the Investment Authority and his briefing on the progress of work and the obstacles facing investment in the country, according to a statement by his office, to “fully adhere to the application of the provisions of Article 28 of the Investment Law by sending warnings to incomplete projects, provided that the National Investment Commission shall supervise And follow-up implementation of procedures, ”and also directed to“ withdraw licenses in the event that the investor does not comply with the completion period.

Al-Najjar told Al-Sabah: “Canceling investment licenses for delayed projects will provide the state with financial resources as a result of the issues arising from these projects, such as customs exemptions on building materials and the characteristics of the entry of large numbers of foreign workers, in addition to ending the control of project investors lagging on state-owned land.”

She added that the directives are an important step that has positive and tangible economic effects, indicating that it will end customs exemptions that affect the local industry, which will contribute to restarting local factories and attracting Iraqi manpower, as well as limiting the granting of entry characteristics for foreign workers that affect the creation of Local employment opportunities.

Al-Najjar emphasized that the directives will contribute to improving and developing investment work, by returning those previously transferred lands and putting them up again to implement real projects that are tangible on the ground.In another matter, the President of the National Investment Commission stated that the (20) thousand housing units in the Basmajah complex that the authority proposed aim to reduce the effects of the housing crisis in the country, indicating that lowering prices and reducing the interest rate, and facilitating facilities in the payment process, were the most prominent measures taken by it.

The Commission in presenting these units, and confirms that the Commission will proceed to address the housing problem that plagues the country.

On 4/21/2021 at 10:01 PM, DinarThug said:Al-Kazemi orders the cancellation of licenses for 1,128 investment projects, and another incomplete warning

21st April, 2021

On Wednesday, Prime Minister Mustafa Al-Kazemi directed the Investment Authority to cancel the licenses of 1,128 investment projects, and to issue warnings for other incomplete projects.Al-Kazemi's office said in a statement received by the "Tigris", that "Prime Minister Mustafa Al-Kazemi visited the Investment Authority and looked at the progress of work and the obstacles facing investment in the country," indicating that "he directed the cancellation of all licenses for investment projects whose completion rate ranges between (0-35%).

The period of time available for the implementation of the project has expired, and the number of projects to which this applies is 1,128 projects.

He added that Al-Kazemi also instructed "full commitment to implement the provisions of Article 28 of the Investment Law by directing warnings to incomplete projects.

The National Investment Commission shall supervise and follow up the implementation of procedures, as well as withdraw licenses in the event that the investor does not adhere to the completion period."

End the power of lagging investors on state land

Thursday April 22, 2021

Baghdad: Hazem Muhammad HabibThe head of the National Investment Commission, Suha al-Najjar, promised Prime Minister Mustafa Al-Kazemi to cancel all licenses for investment projects whose completion rate ranges between (0-35%) And the time period available for its implementation has ended, an important decision, indicating that the directive, which will cancel 1,128 investment licenses, will return to the state about 400 thousand dunams, with an estimated value of 90 trillion dinars.

Al-Kazemi had also directed, during his visit to the Investment Authority and his briefing on the progress of work and the obstacles facing investment in the country, according to a statement by his office, to “fully adhere to the application of the provisions of Article 28 of the Investment Law by sending warnings to incomplete projects, provided that the National Investment Commission shall supervise And follow-up implementation of procedures, ”and also directed to“ withdraw licenses in the event that the investor does not comply with the completion period.

Al-Najjar told Al-Sabah: “Canceling investment licenses for delayed projects will provide the state with financial resources as a result of the issues arising from these projects, such as customs exemptions on building materials and the characteristics of the entry of large numbers of foreign workers, in addition to ending the control of project investors lagging on state-owned land.”

She added that the directives are an important step that has positive and tangible economic effects, indicating that it will end customs exemptions that affect the local industry, which will contribute to restarting local factories and attracting Iraqi manpower, as well as limiting the granting of entry characteristics for foreign workers that affect the creation of Local employment opportunities.

Al-Najjar emphasized that the directives will contribute to improving and developing investment work, by returning those previously transferred lands and putting them up again to implement real projects that are tangible on the ground.In another matter, the President of the National Investment Commission stated that the (20) thousand housing units in the Basmajah complex that the authority proposed aim to reduce the effects of the housing crisis in the country, indicating that lowering prices and reducing the interest rate, and facilitating facilities in the payment process, were the most prominent measures taken by it.

The Commission in presenting these units, and confirms that the Commission will proceed to address the housing problem that plagues the country.

-

1

1

-

2

2

-

-

The launch of the first “digital economy” service a few days later in Iraq: The fate of the fines will be guaranteed .. What does it mean to pay money over the phone?

2021-04-23

Yes Iraq: Baghdad

An American report sheds light on an economic and digital transformation that will be achieved in Iraq in a few days, represented by the launch of one of the famous Iraqi banks for a digital application for financial services, while the transition to the digital economy will be an opportunity to legalize or eliminate financial corruption, and bypass the weakness of the banking infrastructure.

The Iraqi economy is preparing to achieve a technological leap that could allow it to overcome the structural problems and corruption gaps that suffocate the private sector, as the Iraqi Trade Bank will launch on the first of next May its application for financial services via mobile phone.

While this step may be considered simple, paying money via mobile phone has helped many countries in the world to bypass weak physical banking infrastructure, dry up common corruption systems and encourage innovation, according to Dr. Bilal Wahab, a researcher at The Washington Institute, and Michael Rubin, resident researcher at The Washington Institute.

American Enterprise Institute in the analysis published by the American National Interest magazine.

Wahab and Robin say that corruption has been an obstacle to the Iraqi economy for many years, and Transparency International places Iraq among the most corrupt countries in the world, with a slight improvement compared to the level of corruption 10 years ago.

They added that one of the most prominent common denominators between the components of the Iraqi political spectrum is the willingness of politicians to exploit their positions to enrich themselves and their families or for the benefit of their companies, while noting that in the first years after 2003 the Iraqi government used to pay salaries to employees in cash, which opens the door to the inclusion of fake names in Payroll, and it allows presidents to deduct funds for themselves from the salaries of their subordinates, and to counter these practices the government sought to move to a system of paying wages through bank accounts, and this matter has become mandatory for workers in the prime minister and the presidency, but it is still optional for workers in Parliament.

But depositing salaries in bank accounts is not enough for the simple reason that Iraqis do not trust banks, and the use of banking services in Iraq is still low. Until 2017, the percentage of Iraqis who own bank accounts was about 20% of the total Iraqis, and now despite the presence of about seventy banks operating In Iraq, only three major banks, namely Al-Rafidain, Al-Rasheed and the Iraqi Trade Bank, account for about 85% of the total assets of the banking sector.

There is only one large international bank operating in Iraq now, which is Standard Chartered, and it owns a few branches and focuses on major government projects.

The Iraqi International Smart Card won a contract to electronically pay government workers' wages through cards insured with biological agents "Qi Card".

In 2019, the company said it had about 7 million people carrying its cards.

The researchers say that the weakness of the banking system in Iraq is a major reason behind the World Bank placing Iraq in the 186th place out of 190 on the ease of obtaining loans index in the World Bank's report on doing business for the year 2020. This led to a large exit of capital from Iraq.

Ali Allawi, the Iraqi Finance Minister, for example, says that about 250 billion dollars have gone out of Iraq since 2003, which is three times the annual budget of Iraq.

At the same time, the weakness of the banking system has pushed Iraqi citizens to rely more on informal financial transfers, which negatively affects the government's ability to follow the movement of funds and collect taxes and fees.

For example, the public treasury loses about 90% of the potential revenues of customs, estimated at 7 billion dollars annually, due to corruption of officials and armed militias.

At the same time, the central government in Baghdad and the Kurdistan Regional Government are not making sufficient efforts to enhance citizens' confidence in the banking system.

There is a bill in the Iraqi parliament to insure deposits that no one cares about.

In 2014, when the Kurdistan Regional Government faced a liquidity crisis, it seized money from bank deposits, denting citizens' confidence in the banking sector as a whole.

But the new Corona virus pandemic has prompted large numbers of Iraqis to accept the idea of a digital economy.

In Erbil and Baghdad, food delivery applications via smart devices such as Tiptop and Express have increased in popularity.

And in the city of Sulaymaniyah in the Kurdistan region, residents have increased their interest in using the website “PayBook.com” to buy their needs instead of going to stores.

As Iraqis prepare for the digital economy era, as more than 40% of Iraqis were born after the 2003 invasion, the move to enter the Iraqi Trade Bank into the world of mobile banking will reverberate in broader areas of public confidence.

For example, when a car passenger in Iraq is fined 50,000 dinars ($ 34) for not wearing a protective mask against the emerging corona virus, he does not know if the money he will pay reaches the public treasury or goes to the police's pocket.

Whereas, when paying the fine via mobile applications, he will make sure that it reaches the public treasury.

The same applies to various forms of fines and fees that Iraqi citizens pay.

At the same time, the Iraqi Trade Bank’s provision of electronic banking services could allow Iraq to overcome the increasing obstacles to traditional banking infrastructure and corruption caused by overlapping interests.

While most regions of Iraq, such as Karbala, Anbar and Baghdad, have the ability to attract investors and provide them with the opportunity to achieve large profits, financial services via mobile phone will facilitate the practice of commercial activities, help avoid large bank fees and support greater transparency.

Therefore, researchers Bilal Wahhab and Michael Rubin call on the US administration to provide all means of support to the Iraqi government in order to develop the Iraqi banking system and push it towards the transition to a digital economy while ensuring its information security.

At the same time, it is in the interest of the United States to coordinate and cooperate with Iraq to ensure that mobile financial transactions applications that allow currency exchange between dinars and dollars do not turn into a back channel for Iran to circumvent US sanctions.-

4

4

-

3

3

-

-

3 hours ago, horsesoldier said:

Indeed !!! Congrats to all in the Women's Auxillary Balloon Corps

Sweet - Clowns Luv Balloons !

We’re Total Balloon’atics !

Ok - Who Wants Another One ...

-

4

4

-

1

1

-

1

1

-

-

-

8 hours ago, Dinarrock said:

Agreed, personally I am hoping for a rate of about $2.65!!!

37 minutes ago, 3 bucks new rv rate said:me too.

U Mean - Me ‘Two Sixty Five’ ...Unless U Were Just Rounding Down As Part Of The ‘Me Two’ Movement ...

-

1

1

-

7

7

-

-

1 hour ago, screwball said:

The rate is coming get ready peeps

Let’s Bro !

-

11

11

-

-

-

11 minutes ago, GreedyDinar07 said:

Yea they need to move at God’s speed!

Iraq Only Knows How To Move At “Allah’s Speed” !

And Especially During Ramadan ...

-

2

2

-

7

7

-

1

1

-

Mr. Sadr tweets on the budget and warns

in Iraq & Dinar Related News

Posted

Let’s Bro !